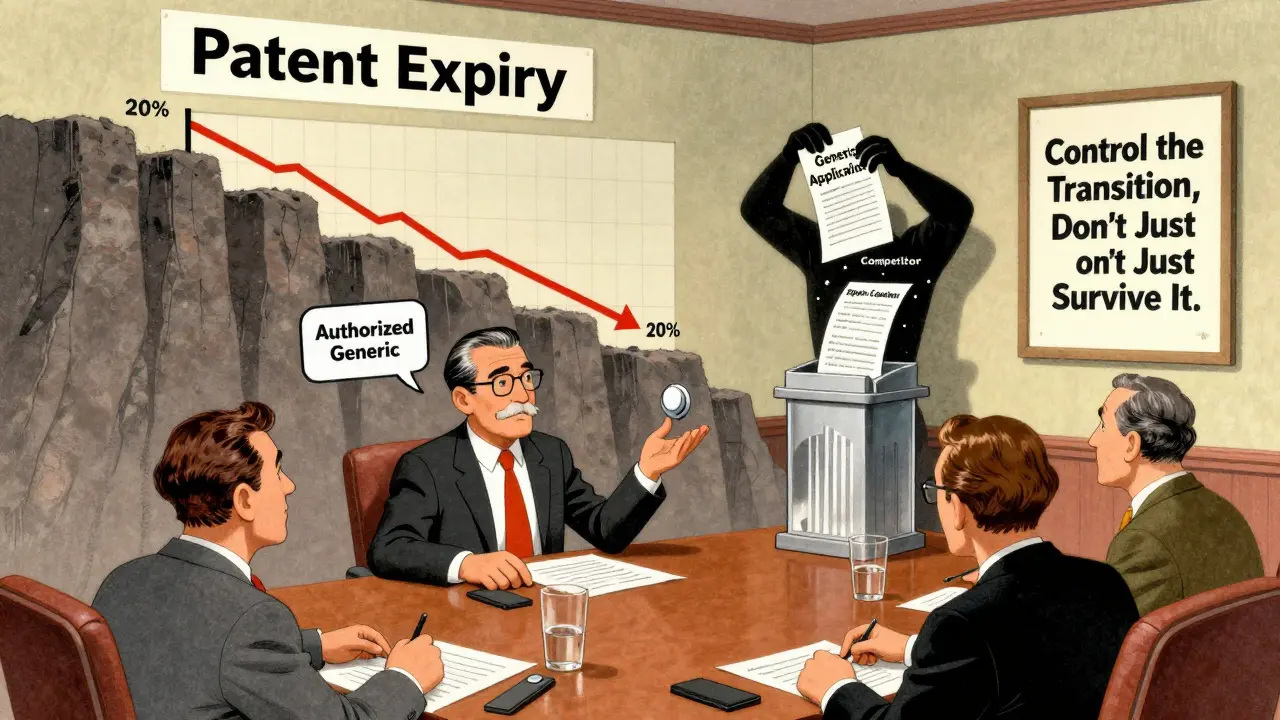

When a blockbuster drug loses its patent, the brand name usually crashes in value - sometimes by 80% or more in just one year. But some companies don’t just sit back and watch their revenue disappear. Instead, they launch something unexpected: authorized generics. These aren’t knockoffs. They’re the exact same pills, capsules, or injections as the original brand drug - same active ingredients, same inactive ones, same factory, same packaging (minus the brand logo). And they’re sold at generic prices. Why would a company undercut its own product? The answer isn’t self-sabotage. It’s strategy.

What Exactly Is an Authorized Generic?

An authorized generic is a version of a brand-name drug produced by the original manufacturer and sold under a generic label. It’s not a copy. It’s the real thing. For example, when Pfizer launched the authorized generic of Celebrex (celecoxib), it was identical to the branded version - same chemical structure, same manufacturing line, same quality control. The only difference? No brand name on the bottle. The FDA allows this because the product is marketed under the original New Drug Application (NDA), not a new generic application (ANDA). That means no extra testing or approval is needed. Just a simple notification to the FDA. This lets brand companies respond in weeks, not the 18 to 24 months it takes for a traditional generic to get approved.Why Launch an Authorized Generic Before the Patent Expires?

Most people assume brand companies wait until generics show up before reacting. But data from 2010 to 2019 shows that 70% of authorized generics were launched before or during the 180-day exclusivity window granted to the first generic applicant under the Hatch-Waxman Act. That’s not defensive - it’s offensive. Here’s how it works: When a patent expires, the first company to file a generic application gets 180 days of exclusive rights to sell that generic. During that time, they can charge high prices with no competition. But if the brand company launches its own authorized generic during that window, it breaks that monopoly. Now the first generic isn’t alone anymore. Two identical products are on the shelf - one from the original maker, one from the new entrant. Prices drop fast. The FTC found in 2011 that when authorized generics entered during this exclusivity period, prices were significantly lower than in markets without them. That’s good for consumers. But it’s also a message to other generic makers: if you think you’re going to cash in on a monopoly, think again.Protecting Market Share Without Losing Everything

Imagine you own a popular soda brand. When a cheaper version hits the market, you could lose 100% of your customers. Or, you could launch your own cheaper version - same taste, same bottle shape, just no logo. You keep some customers who still want the brand. You also capture the price-sensitive crowd. That’s exactly what brand drugmakers do with authorized generics. Instead of losing all revenue when a drug goes generic, companies can retain 15-20% of the market through their own generic version. For a drug that made $1 billion a year, that’s $150-200 million in preserved revenue. That’s not small change. It’s enough to justify keeping production lines running, maintaining skilled staff, and avoiding massive layoffs. Companies like Greenstone Pharmaceuticals (a Pfizer subsidiary) and Amneal have built entire divisions around authorized generics. They don’t just react - they plan for them years in advance.

Consumer Trust Matters More Than You Think

Patients don’t always know the difference between a generic and a brand drug. But when they do, they care. A 2005 study by Roper Public Affairs found that over 80% of Americans wanted the option of an authorized generic. Why? Because they know it’s the same drug they’ve been taking. Traditional generics can have different fillers, coatings, or binders. For most drugs, that doesn’t matter. But for drugs with a narrow therapeutic index - like warfarin, levothyroxine, or seizure medications - even tiny differences can cause problems. Authorized generics eliminate that risk. Doctors prefer them. Pharmacists recommend them. Patients stick with them. That trust gives brand companies an edge no traditional generic can match.It’s Not Just About Price - It’s About Control

Brand companies don’t just drop their authorized generic into every pharmacy. They often place them in specific channels: mail-order pharmacies, big-box retailers, or health system networks. Why? To avoid direct price comparisons with their own branded product. If a patient sees the brand version at $120 and the authorized generic at $15, they’ll choose the cheaper one. But if the brand is only sold through specialty clinics and the generic is only available through CVS or Amazon Pharmacy, the price gap doesn’t directly compete. This segmentation lets the company keep its premium pricing for those who want the brand - and still capture the budget-conscious segment. This tactic has gotten even smarter. In recent years, some companies have launched authorized generics before any generic competitor even files an application. That’s a preemptive strike. It signals to potential entrants: we’re ready, we’ve got the capacity, and we’ll match your price before you even get started. This has changed the game. Where authorized generics used to be a reaction to competition, they’re now a tool to discourage it.

What About the Future? Biologics and Beyond

The same logic is now being tested with biologics - complex drugs made from living cells, like Humira or Enbrel. These drugs are expensive, and their patents are expiring now. But there’s no official path for “authorized biosimilars” yet. The FDA hasn’t defined how they’d work. Still, brand companies are watching closely. If they can launch their own version of a biosimilar - identical to their brand, sold at lower cost - they’ll do it. The financial stakes are even higher. A single biologic can make $5 billion a year. Losing that to multiple competitors would be devastating. An authorized biosimilar could be the next big move in pharmaceutical strategy.Who Wins? Who Loses?

Consumers win. Prices drop faster. Choice increases. Pharmacists win. Fewer complaints about side effects from generic switches. Doctors win. Less uncertainty about treatment consistency. The losers? Traditional generic manufacturers who counted on a 180-day monopoly. They still get a piece of the pie, but it’s smaller. And brand companies? They don’t lose - they adapt. They turn a threat into a controlled transition. They don’t just survive the patent cliff. They manage it.Real-World Examples You’ve Probably Used

- Celebrex → Celecoxib (Greenstone): Pfizer’s authorized generic of the popular arthritis drug. Same pill, lower price. - Concerta → Methylphenidate ER (Actavis): The ADHD medication that saw its brand version drop sharply after the authorized generic hit. - Colcrys → Colchicine (Prasco): A gout drug where the brand had raised prices to over $3,000 per pill - until the authorized generic arrived at under $10. These aren’t niche cases. They’re textbook examples of how authorized generics reshape markets.Are authorized generics the same as regular generics?

Yes and no. Authorized generics are identical to the brand-name drug in every way - same active and inactive ingredients, same manufacturer, same quality. Regular generics only need to match the active ingredient and prove bioequivalence. They can have different fillers, dyes, or coatings. That’s why some patients notice differences with regular generics but not with authorized ones.

Why are authorized generics cheaper than the brand name?

Because they don’t carry the brand’s marketing, advertising, or R&D costs. The brand company already paid those expenses. The authorized generic is sold under a generic label, so it’s priced like one - often at the same rate as other generics in the market. But it’s still the same product you got from the brand.

Can my doctor prescribe an authorized generic?

Yes. Doctors can prescribe the brand name, the generic version, or the authorized generic. Pharmacists will usually fill with the lowest-cost option unless the prescription specifies "dispense as written" or "brand necessary." Many insurers prefer authorized generics because they’re cheaper than the brand but just as reliable as other generics.

Do authorized generics affect the availability of other generics?

They can. When an authorized generic enters the market during the first generic’s 180-day exclusivity, it breaks that monopoly. Other generic makers may delay entering the market because the price has already dropped. But it also means patients get access to lower prices sooner. The FTC found this leads to overall lower drug costs, even if it slows down competition from other generic companies.

Is it safe to switch from a brand to an authorized generic?

Absolutely. Since it’s the exact same drug made by the same company, there’s no risk of switching side effects. In fact, it’s safer than switching to a traditional generic for drugs with narrow therapeutic windows - like thyroid meds or blood thinners - because there’s no change in formulation at all.

8 Comments

So the pharma giants are just playing 4D chess with our prescriptions huh

They don't want to lose money so they make their own cheap version to scare off the real generics

Kinda brilliant if you're a shareholder

Kinda terrifying if you're the person trying to afford your meds

It's like a restaurant owner opening a clone of their own place with no name and cheaper prices just to kill the new diner down the street

And we're supposed to be grateful because the price dropped

Meanwhile they're still making bank on the brand version for people too lazy or trusting to switch

Who wins

Actually nobody

We just get used to being manipulated

Man i never realized how much strategy goes into this

I just thought generics were generics

Turns out there's this whole shadow system where the original company makes the exact same pill but calls it something else

Kinda wild that they can do that legally

My grandma takes warfarin and she swears by the brand but when i showed her the authorized generic label she was like 'wait this is the same factory'

She switched and saved like $80 a month

Still weird to think the company that made the brand is also the one selling the cheap version

Feels like a loophole they spent millions to design

you think this is about pricing

nah

this is the big pharma deep state

they control the FDA

they control the patents

they control the supply chain

the authorized generic is a psyop

they let you think you're getting a deal

but really they're testing your loyalty

next thing you know your insurance only covers the 'authorized' version

and the real generics get pulled

they're building a monopoly under the guise of competition

watch when biologics hit

they'll make 'authorized biosimilars' and charge you $500 for the same thing you used to get for $5

they're not lowering prices

they're rebranding control

THIS IS WHY WE CAN'T HAVE NICE THINGS 😤

Big Pharma is literally playing monopoly with our lives

They make the drug

Then they make the cheap version of themselves

Then they make you feel guilty for wanting the brand

Meanwhile they're raking in billions

And you think you're saving money but you're just being groomed

It's genius

And terrifying

Someone needs to sue them for emotional manipulation 🤬💊

Interesting to see how this works in the US

In India we don't have this kind of system

Generics are just generics

Brand companies either compete or fade away

But here it's like they have a second life

Kinda smart actually

They keep their factory running

Keep their workers employed

And still make money

Not sure if it's good for patients long term

But it's definitely smart business

why do i care about this

i just take my pills

if it works and costs less i don't care who made it

but now i'm paranoid

is my levothyroxine really the same

or is this some trick

did they just sneak in a new filler

or is this just another way to make me feel guilty for not being a pharma analyst

i just want my thyroid to stop acting up

This is actually one of the few times pharma does something that helps people

Lower prices

Fewer side effects from switching

More options

And they didn't even need new legislation

They just used the rules they already had

Doctors and pharmacists should push these more

Patients deserve to know they can get the exact same drug for less

It's not a compromise

It's a win

Let's not overcomplicate it 🙌

Authorized generics are not a strategy

They are a calculated erosion of market competition

The 180-day exclusivity window was designed to incentivize generic innovation

By flooding the market with a clone from the originator

They nullify that incentive

FTC data confirms reduced generic entry rates post-authorized generic launch

This is regulatory arbitrage dressed as consumer benefit

It is not anticompetitive by accident

It is anticompetitive by design

The FDA's notification system is a loophole

And the industry exploited it with surgical precision

There is no moral high ground here

Only profit optimization

Write a comment